December 14th, 2021

Clyfford Still, 1964. Sold in 2020: $18,442,500. Courtesy Phillips

The art market is one of the largest legal unregulated markets in the world, and yet despite its stature at the helm of luxury, it has always been rather traditionalist. However, in the face of a year where by March 2020, auction sales descended almost 76% from the previous year, the pandemic’s economic disruption became the cannon the market needed to catapult it into a new era of global reach and democratized access.

Jean-Michel Basquiat – Portrait of A-One A.K.A. King, 1982. Sold in 2020: $11,500,000. Courtesy Phillips

Specifically, galleries, art fairs, auction houses, and institutions were forced to embrace new sales platforms and technologies, despite decades of reluctance. Simon de Pury, the renowned art auctioneer, dealer, and curator, attests to the market’s technological revolution, as well as its historical hesitation to have one; “In the first ten months of Covid, the market progressed more than it has in the ten preceding years,” he says.

By March 2020, sales in the global art market decreased by 76%; by December 31, that eased to -22% YoY, due to the market movement towards online sales.

Art Market Report 2021, Art Basel & UBS

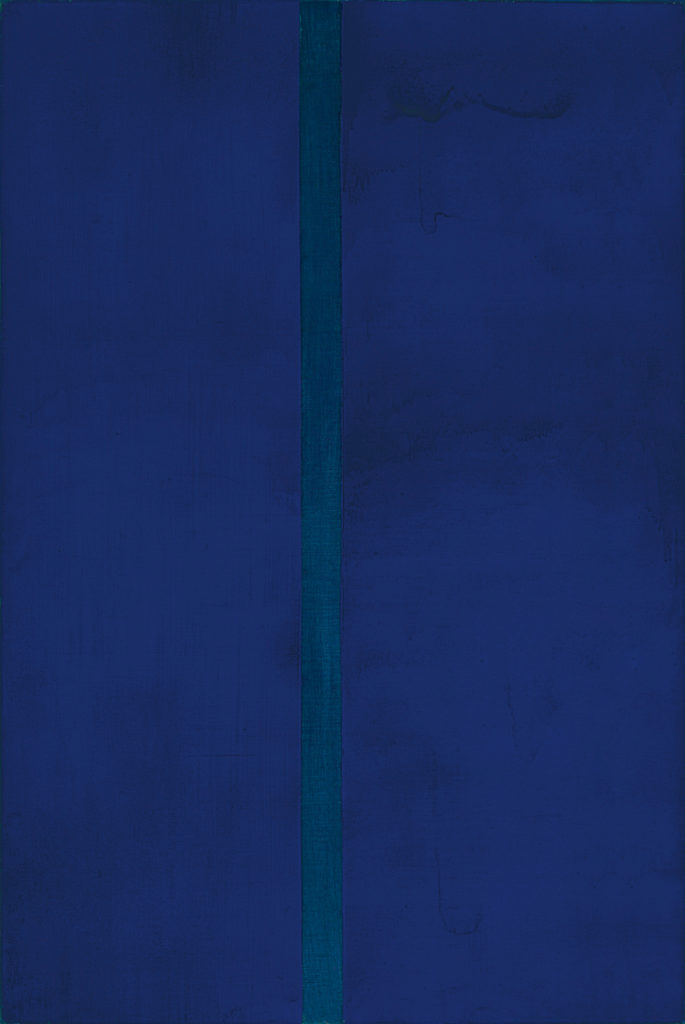

Barnett Newman – Onement V, 1905-1970. Sold in 2020: $30,920,000. Courtesy Christie’s Images LTD. 2021

In an Artsy analysis surveying 1,758 art businesses in 97 countries, 87% of respondents sold art online in some way last year, while one-third reported closing their physical space and moving to a purely online model. On the purchasing side, 30% of collectors who purchased art online did so for the first time in 2020.

Online marketplace Artsyʼs e-commerce sales rose 150% YoY between 2019 and 2020.

Artsy Gallery Insights, 2021 Artsy

George Condo – The Age of Reason, 2010. Sold in 2020: £2,082,369 ≈ $2,869,930. Courtesy Phillips

Digital platforms also encouraged increased price transparency, making for a better user experience for collectors. Galleries had been wary about listing the prices of artworks online “out of a fear of appearing too transactional,” says Dustyn Kim, the Chief Revenue Officer of leading online art sales marketplace, Artsy. Transparent price listings that do not require a buyer inquiry, however, typically make sellers 6 times as likely to sell their work, a critical advantage in a year where in- person access to buyers was severely limited. As a result, there was a staggering 300% year-over-year increase in the ratio of gallery sales to inquiries at Artsy, says Kim.

YOUNGER COLLECTORS EMERGE AS GALLERIES GO VIRTUAL

Notably, online platforms attract much younger collectors, for whom purchasing big ticket items digitally is customary. In 2020, the number of 18 to 34-year-old collectors doubled from the previous year.

Roy Lichtenstein – Nude with Joyous Painting, 1994. Sold in 2020: $46,242,500. Courtesy Christie’s Images LTD. 2021

Access to larger global audiences also allowed galleries to participate in greater social movements and cause-driven work. For example, Artsy raised $8 million in online benefit auctions in 2020, for varied nonprofits and charitable causes. Demand also increased for work by a diverse array of artists, including female artists and artists of color.

Cy Twombly – Untitled (Bolsena),1928-2011. Sold in 2020: $38,685,000. Courtesy Christie’s Images LTD. 2021

A DIGITAL SECONDARY MARKET

Technology was similarly embraced in the secondary market. In 2020, the world’s three top international auction houses organized 644 online- only events, triple the amount of virtual auctions compared to the previous year, according to a 2021 report by Barron’s Consulting. This online embrace also democratized participation and helped auctioneers nurture the aspirational collector.

Jean-Michel Basquiat – Ancient Scientist, 1984. Sold in 2020: HK$58,330,000 ≈ $7,509,579. Courtesy Phillips

“At each one of the big auctions, there have been up to 30% new buyers,” says de Pury, “which shows that there’s a massive renewal of the buyer base, much faster than usual.”

Roy Lichtenstein – White Brushstroke I, 1923-1997. Sold in 2020: $25,417,000. Courtesy Sotheby’s

Willem de Kooning – Women (Green), 1904-1997. Sold in 2020: $23,260,000. Courtesy Christie’s Images LTD. 2021

The U.S. remained the leader of global sales between 2019 and 2020, commanding a 42% share in total sales volume.

Art Market Report 2021, Art Basel & UBS

Edvard Munch – Summer Day or Embrace on the Beach (The Linde Frieze), 1904. Sold in 2021: £16,284,000 ≈ $22,341,517. Courtesy Sotheby’s

During Covid, online auctions at the major houses reached somewhere between 650,000 to 750,000 attendees. While auctions were broadcasted online before the pandemic, Covid massively accelerated not only online viewership, but online bidding and purchases themselves, despite a small percentage of viewers being active bidders. Still, even with increased access, online sales did not completely replace in-person ones, as sales in both the primary and secondary art and antiquities markets fell an estimated 22% from their 2019 levels, according to Art Basel and UBS’s recognized annual Art Market Report.

Pablo Picasso – Femme Dans un Fauteuil, 1881-1973. Sold in 2020: $29,557,500. Courtesy Christie’s Images LTD. 2021

WELCOMING A NEW WAVE OF COLLECTORS

Masterworks, an online platform that allows individuals to invest in blue- chip artwork, has also met newfound success as the art world moves online. Catering to a larger market of individual, smaller investors, rather than institutional investors or ultra-high-net-worth collectors, Masterworks is much like Robinhood for art collectors. It is paving the way for understanding what a digital art market can look like.

Sanyu – Fleurs Dans Un Pot Bleu Et Blanc, 1895-1966. Sold in 2020: HK$187,055,000 ≈ $24,082,583. Courtesy Sotheby’s

In doing so, Masterworks is capturing a millennial collector audience whose buying power will only grow with time and age. According to a recent ART31 survey, 67.8% of young people considered the arts important, but cost and accessibility deterred them from becoming collectors.

Yayoi Kusama – Pumpkin, 1993. Courtesy Masterworks

Mariya Golovina, Masterworks’ Director of Acquisitions, says Masterworks has successfully “addressed the issue of access to the art market by lowering the financial threshold,” so that more admirers can participate.

“The top auction houses held triple the number of virtual auctions in 2020 compared to 2019.”

Simon de Pury Art Auctioneer, Dealer, & Curator

Wayne Thiebaud – Four Pinball Machines, 1920. Sold in 2020: $19,135,000. Courtesy Christie’s Images LTD. 2021

Another trend to note is the recent 2021 arrival of NFTs, or non-fungible tokens, brought to fame by a Christie’s-brokered $69 million sale. The piece, Everydays: The First 5000 Days, a digital collage by artist Mike Winkelmann, also known as Beeple, was sold on Makersplace, an NFT art trading marketplace. NFTs are a blockchain token that can represent or back any asset and can be purchased with cryptocurrency Ether on a marketplace.

This year, many of those backed assets have been digital art. While an NFT collector technically does not purchase any copyrights to the art itself, they simply own the blockchain token that backs it. That token, or NFT, is rendered valuable because it is issued as an exclusive limited edition by the artist him or herself. For the collector, the value and incentive of owning an NFT is the same buy-low-sell-high strategy used in stock trading.

Between 2019 and 2020, the number of small galleries increased by 90%, while the number of medium galleries decreased by 29%.

Artsy Gallery Insights 2021, Artsy

Joan Mitchell – Untitled, 1953-1954. Sold in 2020: $11,297,500. Courtesy Phillips

Change in Gallery Size 2019-2020

Between a growing global collector base, increased accessibility, and brand-new investment platforms, the art world is abundant with opportunity. Over the next decade, a new generation of gallerists, sellers, artists, and collectors will take reign, fundamentally transforming the industry for good.

Sandro Botticelli – Portrait of a Young Man Holding a Roundel, 1480. Sold in 2021: $92,184,000. Courtesy Sotheby’s